Economic Empowerment: ICHSSA-3 Project Transforming Lives Through Village Savings and Loan Association (VSLA)

By Umar Kachalla Gujiba, Halima Nuhu Dikko, Innocent Pius, Boniface Biliyock

Village Savings and Loan Association (VSLA) is a group of people who collectively support a structured process for saving money and offering loans at the local level. They provide a simple and accountable system for savings and loans for communities which do not have ready access to formal financial services or are underserved by the formal financial institutions such as banks or microfinance companies. A major objective of establishing a Village Savings and Loan Association (VSLA) is to support local economic development through financial intermediation.

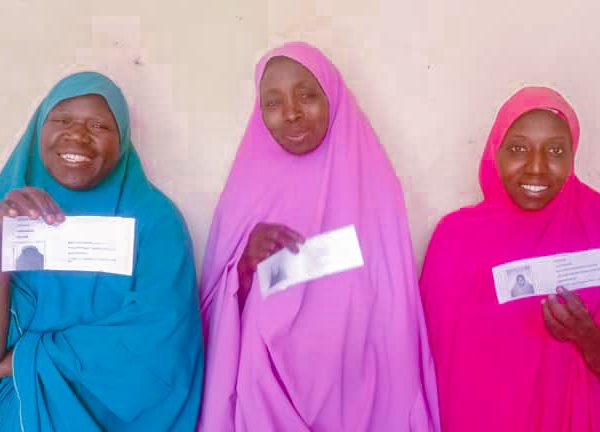

VSLA is one of the Household Economic Strengthening (HES) strategies ICHSSA-3 Project employs to achieve resilience in households. In Yobe, ICHSSA 3 project through the Civil Society organization (CSO) brought together beneficiaries of the project most of which are caregivers of CLHIV households interested in enhancing their financial status and motivated by the need to increase their disposable income and savings. The VSLAs are formed by the Community Case Management Workers to offer financial education (both numeracy and literacy) to members and pull together resources for their empowerment. It enables them to purchase shares, contribute funds at their pace and hold meetings at convenient times from the comfort of their communities.

Under the ICHSSA 3 project in Yobe state, 11 VSLAs were established across the 5 implementing LGAs (Damaturu-1, Fune-1, Fika-4, Potistum-4 & Nangere-1) to help diversify livelihood activities of local people who depend mostly on farming and the exploration of natural resources. The VSLAs bring together community members who save for mutually agreeable objectives and take out small loans from those savings to expand their businesses, pay for their children’s school fees and support household activities. Over the past three months (March – May, 2023), membership of VSLAs has increased to 275 persons with an accumulated savings of N303,000; a third of which was disbursed as loans to members to expand their local businesses while over N50,000 have been contributed as social fund to address unseen eventualities.

The periodic contribution meetings also provided safe spaces to discuss community developmental issues, health challenges, gender norms and promote positive parenting that can enhance their relationships with their children. This in turn translates to children and adolescents receiving adequate attention, care and support from their parents through reinforcement of behaviors learnt during sessions. These properly guided adolescents at risk to avoid social deviances leading to increased risk and are better protected against Gender Based Violence, Violence Against Children, Sexually Transmitted Infections and HIV.

Amina Adamu the Record Keeper and a member of Ansarul Haq Savings and Loans Group of Yindiski Quarters VSLA group: Potiskum LGA had this to say “The VSLA has been very beneficial to a lot of us in the community. During the last cycle, I saved 15,000 (US$37) and received 17,500.00 (US$42). My plan is to reinvest this money in my bean cake business. This is a unique opportunity for self-empowerment. We can better take care of our households if we expand our businesses and increase our savings potential and therefore protect our families”.